is idaho tax friendly to retirees

Whats more Idaho is tax-friendly for retirees. Public and private pension.

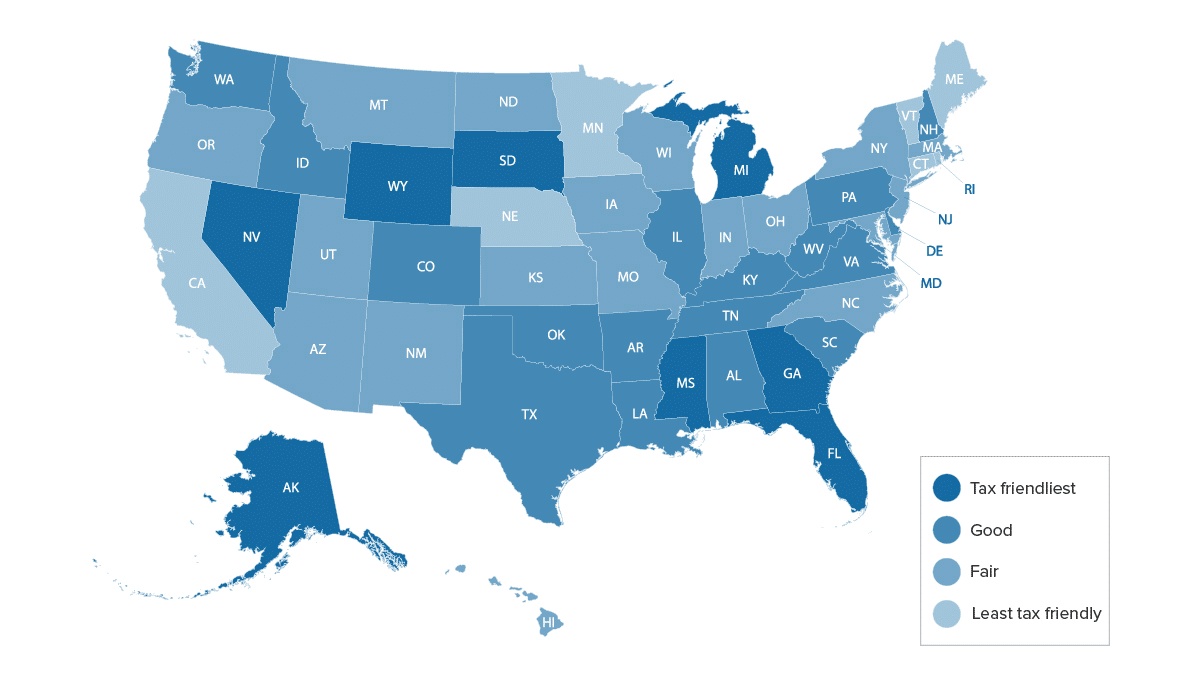

Most Tax Friendly States For Retirees Ranked Goodlife

While potentially taxable on your federal return these arent taxable in Idaho.

. Learn about Idahos Medical Savings Account the Treasure Valleys hospitals and how an interstate move will affect your Medicare. New Look At Your Financial Strategy. Ad Test drive retirement scenarios get custom content and prepare for surprise expenses.

The states that tax Social Security are Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West. Fisher Investments Retirement GPS. Find a Dedicated Financial Advisor Now.

Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire. However it is necessary to consider costs when finalizing retirement plans. Social Security income is not taxed.

A total retirement tool for your unique situation. States were scored on each factor and then ranked against each. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Wages are taxed at normal rates and. Sales tax is at a low 6 while Social Security income and prescription drugs are tax exempt.

This means that you get to retain even. Ad Test drive retirement scenarios get custom content and prepare for surprise expenses. What makes Idaho RETIREE-FRIENDLY.

For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place. Sales tax in Idaho comes in at a low 6 and prescription drugs as well as income from Social Security are not taxable. The state of Idaho offers its senior citizens tax rebates.

Notably Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Yes Is Idaho Tax-Friendly at Retirement.

Youll get the opportunity to breath and. Retiree-friendly plus a low tax burden Pros No sales tax No estate or inheritance tax Average property tax 604 per 100000 of assessed value 2 Social Security benefits. Do Your Investments Align with Your Goals.

A total retirement tool for your unique situation. Idaho is tax-friendly toward retirees. Tax Benefits for Seniors.

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. Idaho is tax-friendly toward retirees. The income tax rate was determined assuming the standard deduction in each state taken by a single filer.

Boise has a lot to offer from plentiful cultural amenities and safe neighborhoods to. Fisher Investments Retirement GPS. Visit The Official Edward Jones Site.

A lack of tax. Exemptions exist for some federal state and local pensions as well as. Recommended as a Retirement Spot.

The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks. Part 1 Age Disability and Filing. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

However according to Idaho instructions Idaho allows for a. Idaho taxes are no small potatoes. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590.

The state income tax is very low starting at 3 percent and stands out as a great place for retirees for other non tax-related reasons such as low cost of living and its warm.

Which State Has The Most Forest Land In The Us And Which Have Made Protecting Evergreen Wildlife A Priority Interestingly United States Map Map State Forest

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Moving To Vancouver Wa Here S What You Need To Know Extra Space Storage Vancouver Travel Moving To Washington State Vancouver Washington

37 States That Don T Tax Social Security Benefits The Motley Fool

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Tax Friendliness Smartasset

Least Tax Friendly States For Retirees Indianer

Here Are The U S States With No Income Tax The Motley Fool

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations States In America

Where To Retire Cover For 11 1 2019 Magazine Titles Magazine Subscription Autumn Park

Most Tax Friendly States For Retirees Ranked Goodlife

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

U S Sales Taxes By State 2020 U S Tax Vatglobal

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Idaho Estate Tax Everything You Need To Know Smartasset

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

The Most Tax Friendly States For Retirees Robert Powell Marketwatch Retirement Tax State Tax